September 7, 2022

TACTICAL STRATEGY ALLOCATION – SPROTT PM PROJECTIONS |

Chris sits down with Craig Hemke of Sprott Money to talk about tactical strategy allocation and the recent moves in precious metals, bonds, and the US dollar.

How will the pending energy crisis in Europe affect global markets?

Is the Central Bank tightening by the US Federal Reserve driving the bond and stock market lower and the US dollar higher?

What effects are these factors, and more, having on precious metals? How do we navigate through this type of market climate?

TACTICAL STRATEGY ALLOCATION = CAPITAL PRESERVATION

At the heart of the investment strategies Chris has developed lay two core focuses:

– protect capital

– do not hold assets falling in value

Tossing out the historical strategy of ‘buy-and-hold-no-matter-what,’ Chris focuses on a position hierarchy of stocks, bonds, currency, and cash positions. If stocks are not in favor, he looks to bonds. If bonds are not in favor, he focuses on the US Dollar ETF UUP. After that comes the inverse dollar ETF UDN and finally T-Bills to earn a little interest while waiting for the next opportunity.

What is interesting here is that the last three positions are essentially cash. When volatility is high, and most people are jumping in and out of trades or trying to pick bottoms or tops, Chris moves to one of these cash positions to better protect capital while still seeing overall growth.

BONDS COULD KILL YOUR RETIREMENT AND LIFESTYLE

Is there any other word to describe the YTD look at the performance of bonds than bloodbath? Having already lost approximately 30% of its value from the high during COVID, one could think, “it can’t get much worse.” What this equates to, though, is trying to pick a bottom – a dangerous gamble for those who are nearing retirement or are already there.

The reality is the bond market could fall by another 20-30%, taking everyone still invested with it. With only 40-50% of their original account balance remaining, those who held on for dear life will have to downgrade their lifestyle and potentially be forced back into the workplace looking for a job to fund their retirements and

US DOLLAR IS NOT WHAT YOU THINK

Looking at the US dollar is a way to get a feel for the fear in the market. It’s also a good signal as to where money is flowing globally. Should the stock market and bonds break down 20-30%, one of the best places to be will be in a cash position. YTD, the US dollar, has been performing really well as an alternate investment, and knowing we can profit from the dollar moving makes it a perfect low-risk way to generate growth.

STOCK MARKET HAS NOT EVEN STARTED A BEAR MARKET YET

Using Fibonacci on the ABC correction on the S&P 500 weekly chart, we can see that the next downside move at .618 and 1.0 is -7% and -19%, respectively. Generally speaking, the bond market will follow the stock market down, and should this happen, the financial outlook of most people will dramatically change for the worse. Unless that is, you implement a strategy, such as CGS, that benefits from this type of environment.

PRECIOUS METALS COULD MELTDOWN BEFORE NEXT MAJOR RALLY

Looking at the Weekly Chart of Gold Futures is a shock to the system of what may be on the horizon. How well have we learned the lessons from the 2013-2016 breakdown? If the support level around $1680 doesn’t hold, where will be the next level of support? Taking the span between two highs and two lows on the chart is a fairly accurate measurement tool and indicates that the $1300 level is not that far-fetched.

CLICK ON THE LINK BELOW TO WATCH THE LATEST PRECIOUS METALS FORECAST – IS IT TIME TO GIVE UP THE BUY-AND-HOLD STRATEGY?

GET CHRIS VERMEULEN’S ETF TRADE SIGNALS AT:

WWW.THETECHNICALTRADERS.COM

Sept 3, 2022

Looking good for the bull camp, we are right at possible Fibonacci support on our SPX monthly chart. The 4400 level may a challenge on any possible rallies we may see.

OEXTrader.com

BREAKING DOWN ETFS – WHAT THEY ARE AND HOW THEY HELP BUILD WEALTH |

The idea of pooling investment assets has been around for centuries. Mutual Funds first appeared in the 1920s. But it wasn’t until the 1980s that mutual funds became widely popular with mainstream investors. In recent years, ETFs have taken off as an alternative to mutual funds.

An exchange-traded fund (ETF) is a “basket” of stocks, bonds, or other financial instruments that gives convenient exposure to a diverse range of assets. ETFs are an incredibly versatile tool that can track anything from a particular index, sector, or region to an individual commodity, a specific investment strategy, currencies, interest rates, volatility, or even another fund. You can do about anything with them — hold a diversified portfolio, hedge, focus on a particular sector, or even profit in a bear market.

The most significant practical difference between mutual funds and ETFs is that ETFs can be bought and sold like individual stocks —and mutual funds cannot. Mutual funds can only be exchanged after the market closes and their Net Asset Value (NAV) is calculated. Shares of ETFs can be traded throughout regular market hours, like shares of stock.

Both mutual funds and ETFs have expense fees that can range from low to high. Mutual funds can have front or backend loads or redemption fees in addition to management fees. ETFs that trade like shares have commissions to buy and sell. But some ETFs are so popular that brokers offer commission-free trading in them.

SO MANY CHOICES

The sheer number and variety of ETFs can be a bit mind-boggling. Over the last 20 years, we’ve seen just a couple hundred ETF offerings grow to more than 8,000 worldwide, encompassing more than 10 trillion in assets.

A surprising number of ETFs have failed. They started with an interesting focus (well, “interesting” to somebody) but failed to attract enough interest to remain viable. For this very reason, I avoid narrow niche ETFs that trade with low volume.

I eliminate many ETFs on poor liquidity alone. I’m not interested if there’s not much volume in a product. I don’t want to suffer high slippage from wide bid/ask spreads. I want to get in and out quickly and at fair prices.

TO LEVERAGE OR NOT TO LEVERAGE?

Inverse and leveraged ETFs often use derivatives like options, futures, and short-term contracts to achieve 2x or 3x the daily change in the assets they’re intended to track. These types of instruments have inherent time decay, and they tend to lose value over time, regardless of what happens in the index or benchmark that the ETF tracks. As a result, these products are best for very short holding periods or day trading.

OPTIONS ON ETFS

Many ETFs have options (puts and calls) available. But even if the ETF itself trades with decent volume, that does not mean that the options meet my criteria for liquidity.

Sometimes I will use long options – puts or calls — if a clear directional move is in play. I also use many of my option premium selling strategies on popular ETFs. Just like with stocks, options can be used with ETFs for additional leverage, collecting premiums for income, and risk management.

AN ETF PLAYLIST

Here are some of my favorite ETFs and how I use them.

SPY, QQQ, IWM – Major index ETFs with huge participation. I use options strategies with these to collect premiums or profit from longer-term directional moves.

XLE, XLF, XHB, IYT, XLU, SMH – Sector Exposure. These can work well for directional trades in specific sectors. I like these sector plays as they can give a lot of protection against individual stock risk.

DBC, USO, UNG, WEAT, GLD, SLV, COPX, GDX, URA – Commodity Exposure. All of these can work well when the underlying commodities are appreciating. I tend to use these with option premium selling strategies such as covered calls and diagonal spreads.

TQQQ – Triple leveraged to the QQQ. This very popular ETF can work well to capture very short-term bullish moves in the Nasdaq 100 stocks.

SQQQ – This is the companion inverse ETF to TQQQ. It is triple-leveraged and inverse to QQQ. Long calls on SQQQ can work well to capture gains from a very short-term down move. Timing is everything in short-term trading, so I get in and out quickly, with trades lasting no more than a few days.

UUP – US Dollar Index. This can be a real winner when stocks are weak and the dollar is strong. Implied volatility on options is relatively low, so buying call options can work well if you catch a directional move. Using calls can give about 10x leverage; for example, a 3% increase in UUP might yield around a 33% gain for an in-the-money call option.

TECHNICAL ANALYSIS

Whether an individual stock or an ETF, my answer for when to buy or sell is always based on price action. We only want to hold assets that are increasing or at least keeping their value while avoiding assets that are in decline. And the toolset to evaluate price action is technical analysis. The same technical analysis we use for stocks works just as well for the more popular ETFs.

Sign up for my free trading newsletter, so you don’t miss the next opportunity!

WANT TO LEARN MORE ABOUT OPTIONS TRADING?

Every day on Options Trading Signals, we do defined risk trades that protect us from black swan events 24/7. Many may think that is what stop losses are for. Well, remember the markets are only open about 1/3 of the hours in a day. Therefore, a stop loss only protects you for 1/3 of each day. Stocks can gap up or down. With options, you are always protected because we do defined risk in a spread. We cover with multiple legs, which are always on once you own.

Our Options Trading Specialist, Brian Benson, continues to knock his trades out of the park. His current win rate is 90%, meaning of the last 20 trades, 18 have finished in the money!

If you are new to trading or have been trading stock but are interested in options, you can find more information at The Technical Traders – Options Trading Signals Service. Brian, who has been trading options for almost 20 years, sends out real live trade alerts on actual trades, such as TSLA and NVDA, with real money. Ready to subscribe, click here: TheTechnicalTraders.com.

Enjoy your day!

Chris Vermeulen

Founder & Chief Market Strategist

TheTechnicalTraders.com

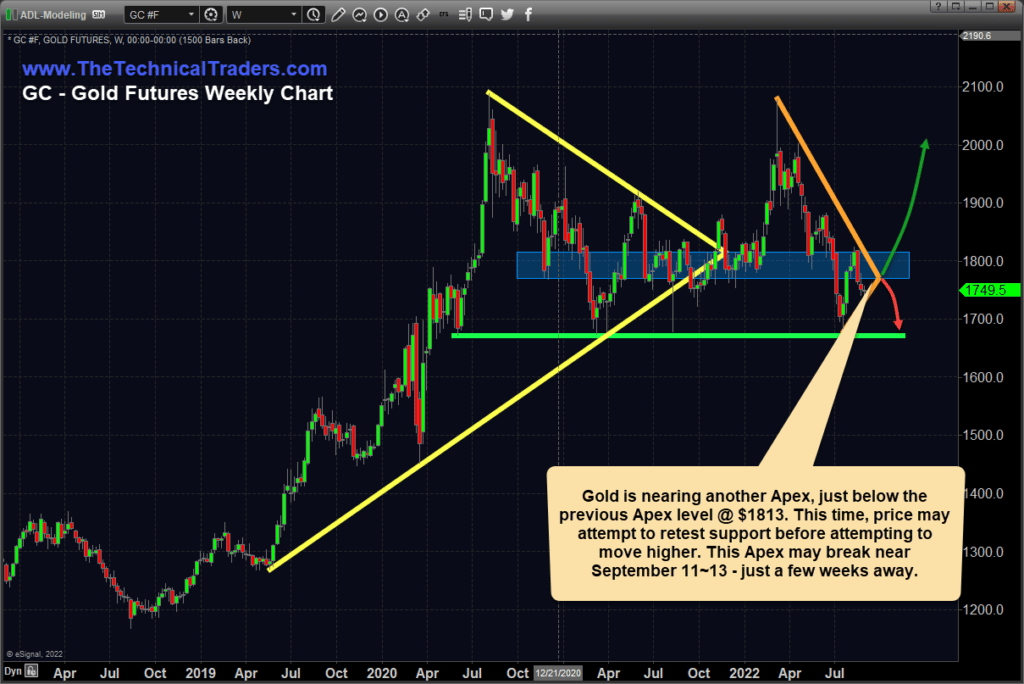

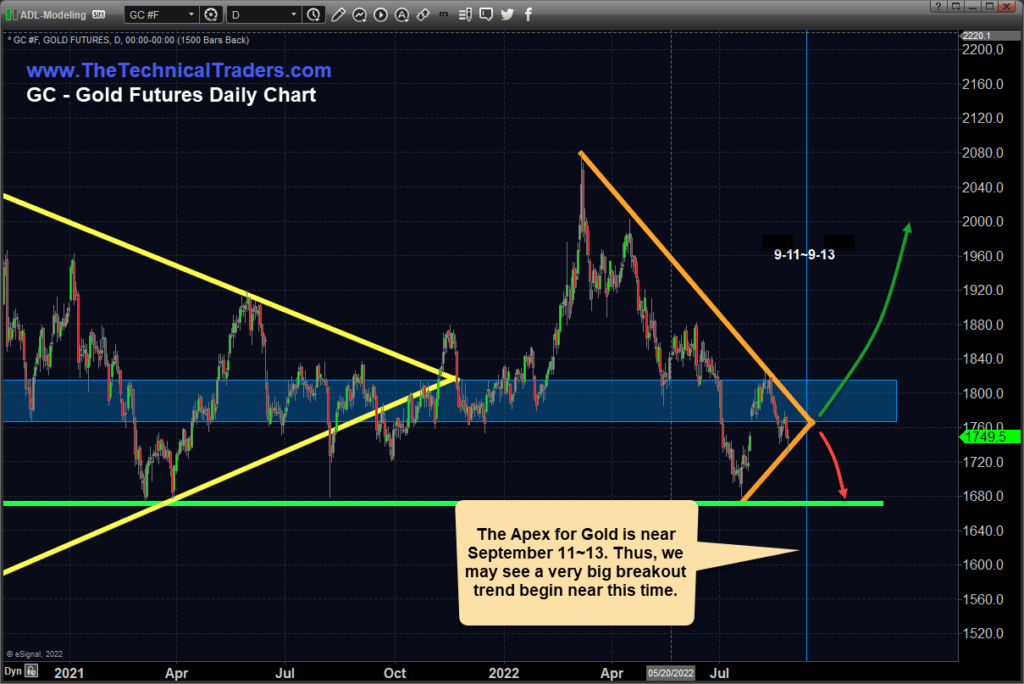

NEW GOLD APEX PATTERN – HOW WILL THE US FED RATE DECISION AFFECT THIS? |

My research shows a new Gold Apex pattern is set up for September 11~15. Around September 11 or after, Gold will attempt to reach this new Apex level near $1766. This price pattern is important because the US Fed rate decision date is September 20~21, and a host of economic data reporting comes out the week before the Fed decision.

My educated guess is Gold & Silver will begin a volatile breakout move, possibly rolling lower to retest support near $1672, before attempting to move higher as global fear starts to elevate. I believe the current lower support level is critical to understanding the opportunities in Gold. If the $1672 level is breached to the downside, it means that Gold has lost a critical support level and will likely trend lower.

Given the statement by Powell last Friday, it seems the US Fed will not pivot and will do what is necessary to tame inflationary trends. Recently I posted two articles about Gold and the Fed that you should review as we move toward the September 11~15 dates.

- August 9, 2022: GOLD-TO-SILVER RATIO HEADING LOWER – SETUP LIKE 1989-03

- August 3, 2022: SHOULD WE BE PREPARED FOR AN AGGRESSIVE U.S. FED IN THE FUTURE?

WEEKLY GOLD CHART

I suspect the $1766, the current Apex level, will play a critical role as new support/resistance going forward. The strength of the US Dollar should have weakened Gold more aggressively, but Gold is holding up quite well in the face of an ever-stronger US Dollar.

Some major event may occur near September 11~15 – just before the Fed rate decision on September 20~21.

DAILY GOLD CHART

Price Apex patterns, like this one in Gold, usually resolve with an aggressive volatility event before establishing any new trends. I often term these events a “washout rotation.”

For example, look at the Apex of the previous (YELLOW) Flag/Pennant formation. A price neared the Apex, but it stayed low compared to the lower yellow boundary. Then, a price reached the true Apex, and a broad 6.5% price rotation took place, eventually settling near $1780.

What happened next was price settled into a rally phase originating near $1780 and continuing up to $2077 – a +17.75% rally.

CONCLUDING THOUGHTS

I can’t predict the future any better than you can. But I do understand Flag/Pennant formations. I believe the current Pennant formation in Gold will resolve to the upside – possibly launching Gold into another significant rally phase.

I continue to warn my followers that Gold and Silver must initiate a new upward price trend to break free of the current downward price trend. Yes, we saw a strong rally attempt in early 2022, but that topped out and slid down over the past 4+ months. Now, as we resolve the current Price Apex, we’ll need to see a substantial price rally above $1828 to confirm any potential for a new bullish rally phase in Gold.

HOW CAN WE HELP YOU LEARN TO INVEST CONSERVATIVELY?

At TheTechnicalTraders.com, my team and I can do these things:

- Safely navigate the commodity and crude oil trend.

- Reduce your FOMO and manage your emotions.

- Have proven trading strategies for bull and bear markets.

- Provide quality trades for investing conservatively.

- Tell you when to take profits and exit trades.

- Save your time with our research.

- Proved above-average returns/growth over the long run.

- Have consistent growth with low volatility/risks.

- Make trading and investing safer, more profitable, and more educational.

Sign up for my free trading newsletter, so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition. Click on the following link to learn how: www.TheTechnicalTraders.com.

Chris Vermeulen

Founder & Chief Market Strategist

Aug 16, 2022

Approaching the 50 day again on our NYA chart.

OEXTrader.com

ARE THE US MARKETS IN STAGE #4 OF THE EXCESS PHASE PEAK PATTERN? |

In 2020 & 2021, we published a very well-received series of articles related to a longer-term pattern we called the Excess Phase Peak pattern. At that time, we highlighted the five (5) components of the Excess Phase Peak pattern and provided a number of examples showing how it usually played out for traders.

You can review our first article: How To Spot The End Of An Excess Phase.

One more article to review is Revisiting The Excess Phase Peak Pattern, which contains links to many of our previous Excess Phase articles. We received so many comments and emails from this article that we thought now would be a great time to bring it forward once more. It highlights how the SPY appears to be moving into a Stage #4 Excess Phase Peak pattern again. Recently we’ve seen the SPY move through Phases 1, 2, & 3. Now, we need to see if the next breakdown in price will start or confirm the Phase #4 price breach.

WHY IS THE EXCESS PHASE PEAK IMPORTANT?

The Excess Phase Peak pattern is a very common transitional phase for the markets where psychology and economic trends shift over time. Global markets typically require periods of pause, reversion, or a reset/revaluation event to wash away excesses. We’ve seen these types of setups happen near the DOT COM and 2007-08 market peaks. What happens is traders are slow to catch onto the shifting phases of the Excess Phase Peak and sometimes get trapped thinking, “this is the bottom – time to buy.”

The reality is that as long as the individual phases of the Excess Phase Peak continue to validate (or confirm), then we should continue to expect the next phase to execute as well. In other words, unless the Excess Phase Peak pattern is invalidated somehow, it is very likely to continue to execute, resulting in an ultimate bottom in price many months from now.

THE 5-PHASES OF THE EXCESS PHASE PEAK PATTERN

The Excess Phase Peak Pattern starts off in a very strong rally phase. This rally phase normally lasts well over 12 to 24 months and is usually driven by an extreme speculative phase in the markets.

Once a price peak is reached and the markets roll downward by more than 7~10%, that’s when we should start to apply the five unique phases of the Excess Phase Peak Pattern. If each subsequent phase validates after the peak, then the Excess Phase Peak Pattern is continuing. If any phase is invalidated, then the pattern has likely ended. For example, if we start by completing Phase #1 & #2, then the market rallies to a new all-time high – that would invalidate the Excess Phase Peak Pattern.

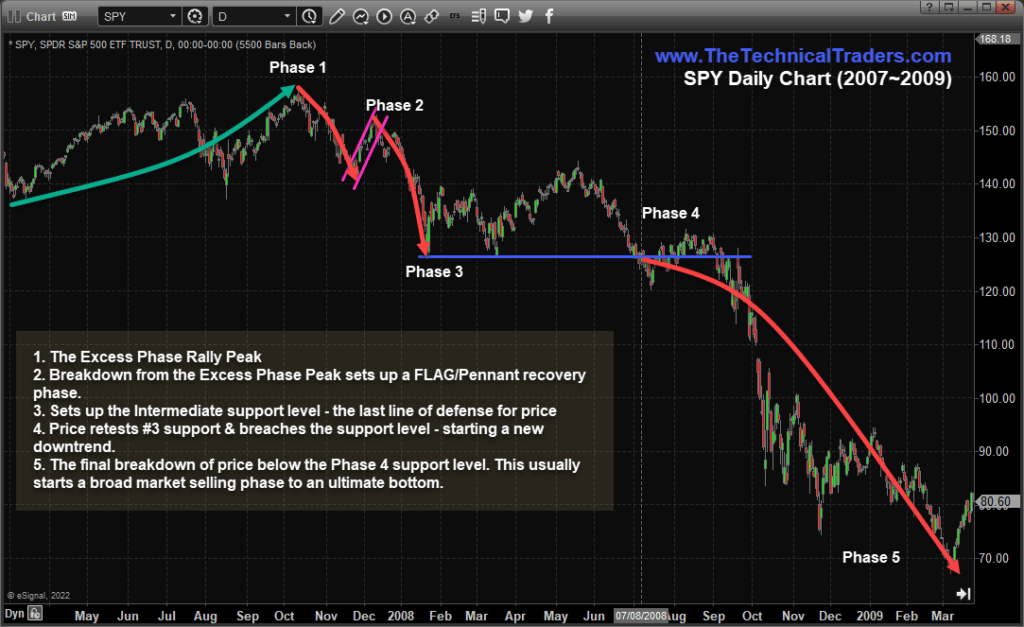

Here are the Phases of the Excess Phase Peak Pattern:

- The Excess Phase Rally Peak

- A breakdown from the Excess Phase Peak sets up a FLAG/Pennant recovery phase.

- Sets up the Intermediate support level – the last line of defense for price.

- Price retests #3 support & breaches the support level – starting a new downtrend.

- The final breakdown of the price is below the Phase 4 support level. This usually starts a broad market selling phase to an ultimate bottom.

Now, let’s take a look at the 2007-09 SPY market peak to see how these phases played out.

2007-2009 EXCESS PHASE PEAK PATTERN

Highlighted on the chart below, Phase #1 & #2 played out perfectly, with a lower high for Phase #2 and a Phase #3 breakdown. By the time Phase #2 broke downward, we should have been keenly aware of the potential for a Phase #3 support level to set up and extend.

Phase #3 can sometimes result in an upward-sloping support channel (like a Bear Flag), but in this case, it is validated as a horizontal support level. We could have used the May 2008 peak as a reversal/breakdown trigger showing us an early Phase #3 change in trend. Having said that, until the Phase #3 support level is breached – these could turn into false breakdowns.

Once Phase #3 support is breached, and we clearly start a deeper downward price trend (moving into the Phase #4 search for the ultimate bottom), traders need to stay very cautious of risks. Phase #3 is one of the most troubling and difficult phases to navigate. It always seems like a “perfect new bottom in price” – until Phase #4 hits.

Ultimately, a Phase #5 bottom sets up (the ultimate bottom), and this usually coincides with extreme selling pressures. Often, the US or foreign governments are involved in trying to contain global risks or address global corporate/financial concerns. We must wait for confirmation of a bottom before we can really take advantage of the lower price levels – but this can be accomplished using technical indicators and price theory.

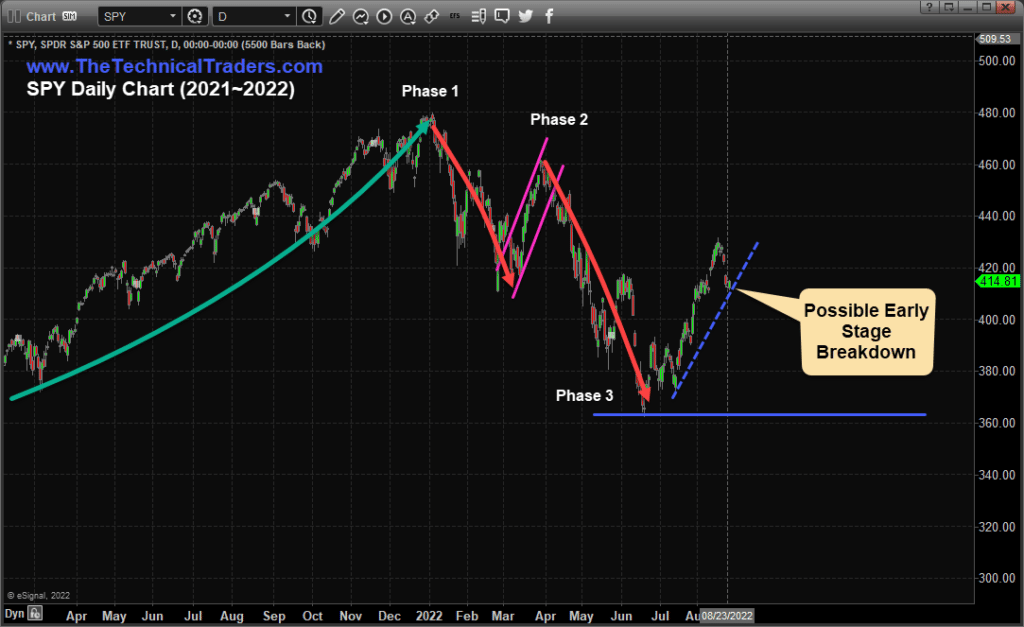

THE CURRENT 2022 EXCESS PHASE PEAK PATTERN SETUP

On the chart below, I estimate we are in the midst of an early Phase #3 potential reversal setup. We’ve already seen a very clear Phase #1 peak, a -13.80% downtrend setting up the Phase #2 bullish Flag/Pennant trend. Then we watch as the Phase #2 breakdown took place, resulting in another -21.60% price decline. Those lows set up the current Phase #3 base/support level near $363.

I’m cautiously watching the blue-dashed trend line as a potential early warning trigger for the Phase #3 bullish recovery cycle. Usually, within a Phase #3 recovery, after establishing critical support, the rally phase becomes very important to validate/confirm the potential Phase #4 & #5 processes.

If the Excess Phase Peak Pattern is going to invalidate at this point, the critical support level will stay unbroken, and a new upward price trend will be established from the Phase #3 support/bottom. So, this is when we need to watch very cautiously for any significant shift in central bank policies, foreign capital risks, shifting sentiment, or anything else that may provide the needed support for the markets to keep rallying higher. Otherwise, we should expect the Excess Phase Peak to continue unfolding.

IN CONCLUSION

Traders and Investors should stay very cautious in this phase of the markets. Going “all-in” with a bullish or bearish expectation right now can be very dangerous to your bottom line.

Learn why I rely on my proprietary CGS, BAN, and TTI strategies to assist in identifying opportunities in various market trends and how I use these to find opportunities to trade within the Excess Phase Peak Pattern. Volatility is still quite high, and there are opportunities for great trades if you understand risk factors.

LEARN FROM OUR TEAM OF SEASONED TRADERS

In today’s market environment, it’s imperative to assess our trading plans, portfolio holdings, and cash reserves. As professional technical traders, we always follow the price. At first glance, this seems very straightforward and simple. But emotions can interfere with a trader’s success when they buck the trend (price). Remember, our ego aside, protecting our hard-earned capital is essential to our survival and success.

Successfully managing our drawdowns ensures our trading success. The larger the loss, the more difficult it will be to make up. Consider the following:

- A loss of 10% requires an 11% gain to recover.

- A 50% loss requires a 100% gain to recover.

- A 60% loss requires an even more daunting 150% gain to simply break even.

Recovery time also varies significantly depending upon the magnitude of the drawdown:

- A 10% drawdown can typically be recovered in weeks to a few months.

- A 50% drawdown may take many years to recover.

Depending on a trader’s age, they may not have the time to wait nor the patience for a market recovery. Successful traders know it’s critical to keep drawdowns with reason, as most have learned this principle the hard way.

Sign up for my free trading newsletter, so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition. Click on the following link to learn how: www.TheTechnicalTraders.com.

Chris Vermeulen

Founder & Chief Market Strategist

CRUDE OIL PRICES – WILL THEY HOLD ABOVE KEY SUPPORT LEVEL OR BEGIN TO UNWIND? |

Talk of a Global Recession may prompt a broad decline in Crude Oil prices as the excesses of the past 10+ years unwind. This unwinding process pushed to the forefront for traders and investors has been prompted by a massive inflationary expansion after the COVID-19 lockdowns. How will it play out in the short-term and long-term?

UNWINDING EXCESS PRICE CYCLE PHASE MAY PUSH CRUDE OIL BELOW $60 PPB

I believe Crude Oil will contract as the initial reduction in demand associated with high-priced gasoline and oil products and the threat of a Global Recession recede. This decline in Crude Oil prices is complicated as China/Asia economic and COVID crisis events continue to disrupt consumer discretionary income and asset valuation levels.

Crude Oil prices are an excellent measure of consumer engagement and activity worldwide. As an economy grows, demand for Crude Oil increases as manufacturers, suppliers, service & support companies, and shipping companies must keep up. When an economy slows, or consumers decrease spending habits, Crude Oil starts declining as overall demand decreases.

The best way to interpret this is that consumers spend willingly when stocks and home prices skyrocket. Yet, they turn away from spending when stocks and home prices turn downward. It is a natural, psychological reaction to unknowns and stress.

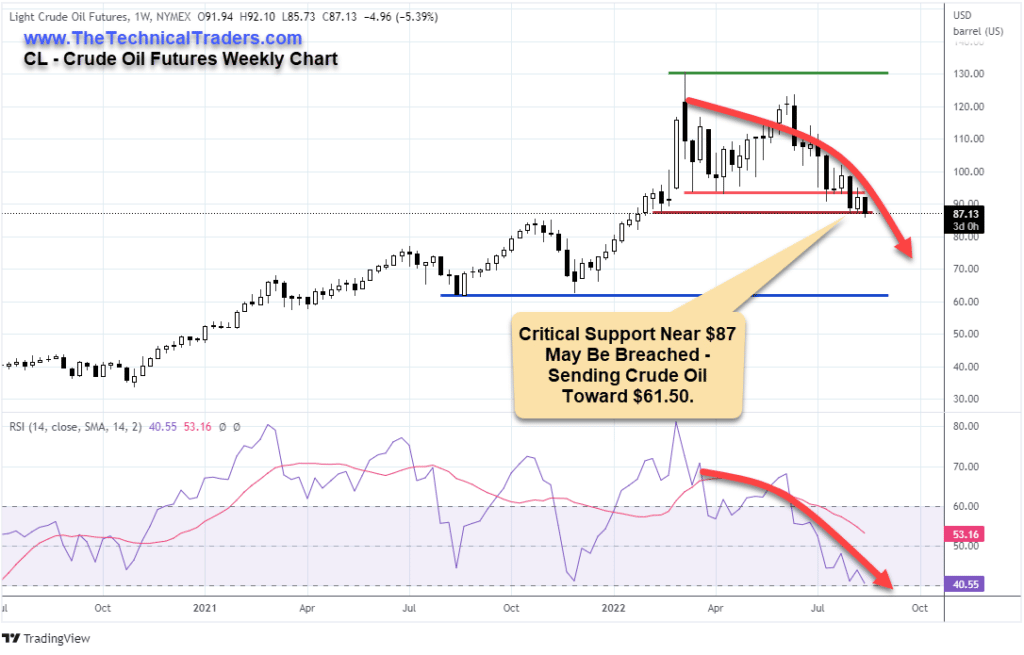

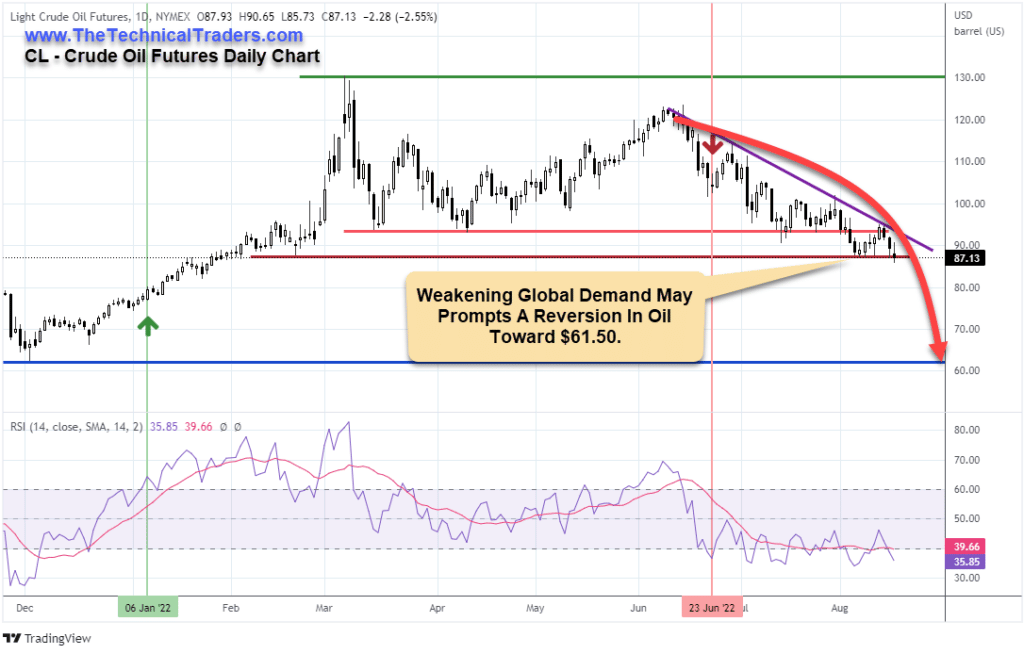

CRITICAL SUPPORT NEAR $87 MAY SOON BE BREACHED

This Daily Crude Oil Chart highlights the key price highs and lows as Fractal levels. It is essential to understand that the nearest real support level below $87 is just above $61 for Crude Oil. If Crude Oil continues to slide downward, I believe a strong downward price trend may occur if the $87 support level is breached.

This would also suggest that a broad energy sector decline could take place over a 30~60-day period as Crude Oil attempts to identify new support. Yet, I believe this downward trend will be temporary in the longer-term scope of Crude Oil trends.

After the 2007-08 Global Financial Crisis, Crude Oil collapsed by -77%, from $145 to $34, then rallied +232% to over $113 by 2011. If a Global Recession phase continues through the end of 2022 or into 2023, I suggest the recovery phase will prompt a solid recovery in Crude Oil prices over the next 3+ years.

POST-COVID EXCESSES SEEM SIMILAR TO THE 2007-08 MARKET PEAK

The initial contraction in the US markets throughout the start of the 2007-08 Global Financial Crisis occurred during an extended peaking pattern in the US stock market. It began to gain downward momentum as the US financial system started breaking down (Lehman, Bear Sterns, & Others). The collapse in the financial markets broke consumer expectations and spending habits as demand for commodities collapsed.

This same type of market malaise seems to be currently taking place as the post-COVID rally phase has run its course and the global markets slide into a sideways price malaise – waiting for the “Lehman Moment.”

I suspect the current demand destruction related to inflationary trends, high gasoline prices, and the threat of another global house price peak may be sending consumers into a similar contraction cycle. This is why I believe Crude Oil will slide below the $87 price level and attempt to find new support near $61 before we see any real upward price trends in the energy sector.

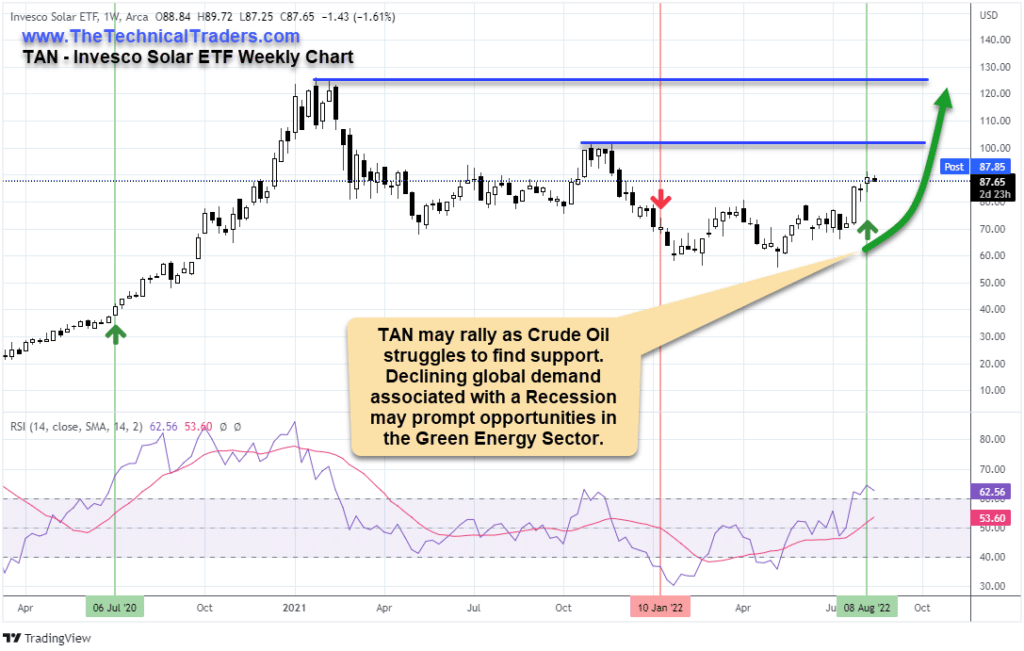

ALTERNATE ENERGY MAY SURPRISE WHILE OIL MOVES DOWNWARD

Providing an opportunity for traders, Solar, Battery, and other new forms of energy may experience a boom cycle while Crude Oil contracts. Crude Oil is used in all forms of manufacturing, transportation, and other aspects of the global economy. Yet, while Crude Oil contracts, alternative energy sources may experience a rising price cycle.

President Joe Biden just signed the Inflation Reduction Act into law, pushing a massive $369 billion into new energy security and climate change (Source: Smartasset.com). This new investment in alternative energy sources, green energy, and increased Crude Oil supply will dramatically shift opportunities within the Energy Sector.

TAN, the Invesco Solar Energy ETF, may rally more than 15% to levels above $101 before possibly continuing higher to retest the $120 to $125 2021 highs.

Learn how our Total ETF Portfolio strategies can help you more efficiently protect and trade these big sector trends while keeping you away from high-risk setups.

LEARN FROM OUR TEAM OF SEASONED TRADERS

In today’s market environment, it’s imperative to assess our trading plans, portfolio holdings, and cash reserves. As professional technical traders, we always follow the price. At first glance, this seems very straightforward and simple. But emotions can interfere with a trader’s success when they buck the trend (price). Remember, our ego aside, protecting our hard-earned capital is essential to our survival and success.

Successfully managing our drawdowns ensures our trading success. The larger the loss, the more difficult it will be to make up. Consider the following:

- A loss of 10% requires an 11% gain to recover.

- A 50% loss requires a 100% gain to recover.

- A 60% loss requires an even more daunting 150% gain to simply break even.

Recovery time also varies significantly depending upon the magnitude of the drawdown:

- A 10% drawdown can typically be recovered in weeks to a few months.

- A 50% drawdown may take many years to recover.

Depending on a trader’s age, they may not have the time to wait nor the patience for a market recovery. Successful traders know it’s critical to keep drawdowns with reason, as most have learned this principle the hard way.

Sign up for my free trading newsletter, so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition. Click on the following link to learn how: www.TheTechnicalTraders.com.

Chris Vermeulen

Founder & Chief Market Strategist